The Emergence of the BRICS International Union of States

In an era characterized by rapid economic growth, the BRICS coalition stands as a testament to the achievements of emerging economies. Coined by economist Jim O’Neill, the acronym BRICS includes Brazil, Russia, India, China, and South Africa, five nations who have experienced sustained economic growth in recent years. What originated as an economic projection has evolved into a significant geo-political alliance, encompassing 42% of the world’s population and over 31% of the global GDP, according to the World Factbook.

The coalition started as an informal bloc in 2009, when its founding members––China, India, Russia and Brazil––hosted their first summit with the goal of increasing their influence in global affairs. A year later, the bloc expanded to include South Africa, giving hope to other developing countries with comparable populations and GDP. As previously referenced, the concept of BRICS was originally created by Goldman Sachs economist Jim O’Neill in his paper “Building Better Global Economic BRICs” to reflect the growth potential for the original four countries. O’Neill argued that “world policymaking forums should be re-organized and in particular, the G7 should be adjusted to incorporate BRIC representatives.”

The member countries are actively working towards securing a more influential role in global governance, challenging the historical dominance of Western countries in key international institutions. Among BRICS’ most notable achievements are the establishments of the New Development Bank (NDB) and the Contingent Reserves Arrangement, which aim to ensure equality among shareholders and offer loans in local currencies. These institutions offer an alternative source of development financing, countering the Western-centric World Bank and IMF, which have faced criticism for solely appointing American presidents and European managing directors. Notably, the IMF gives only a 15% collective voting power to the five BRICS nations, despite constituting 26% of the world’s GDP, as reported by the Economic Times. By establishing new avenues of funding international development, the BRICS coalition has gained agency on the global stage.

The NDB launched in 2016 with an initial capital of $50 billion and has swiftly gained relevance by allotting $32 billion for 96 projects across its founding five members. The NDB also expanded its membership for the first time in 2021, welcoming Bangladesh, Egypt and the United Arab Emirates. Unlike conventional banks, the NDB stands out for its local-currency lending, aligning with the BRICS countries’ aspiration to reduce reliance on the U.S. dollar. This not only lessens the debt burden on borrowing nations but also protects them from potential financial sanctions tied to the dollar’s status as the global reserve currency.

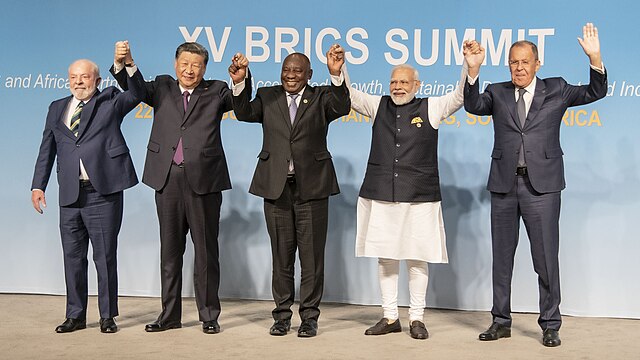

This August, BRICS expanded for the first time in more than a decade by welcoming Saudi Arabia, Iran, Ethiopia, Egypt, Argentina and the United Arab Emirates. The motivations behind each nation’s decision to join are as diverse as their geographic locations. The UAE and Saudi Arabia bring their considerable oil power, while Iran and Russia share the common challenge of navigating U.S. sanctions. Ethiopia and Egypt’s membership amplifies Africa’s voice in global affairs. Chinese President Xi Jinping hailed this expansion as “historic,” saying “it shows the determination of BRICS countries for unity and cooperation with the broader developing countries.” South African President Cyril Ramaphose gave a similar statement, calling the expansion an “effort to build a world that is fair, a world that is just, a world that is also inclusive and prosperous.”

The future of BRICS holds the promise of a more inclusive platform for global dialogue and cooperation. With the addition of new member nations, BRICS seeks to address the imbalance of power and representation in international institutions. Initiatives like trading in national currencies signify a shift away from the traditional reliance on the U.S. dollar and an effort to provide more financial autonomy to member nations. As the BRICS alliance continues to expand and adapt, it may ultimately contribute to shaping a more balanced and equitable order that better addresses the concerns of the developing world.